how to calculate sales tax in oklahoma

Oklahoma collects a 325 state sales tax rate on the purchase of all vehicles. The most populous county.

How To Calculate Sales Tax How To Find Out How Much Sales Tax Sales Tax Calculation Youtube

Multiply the vehicle price after trade-ins and incentives.

. In Oklahoma this will. The equation looks like this. Enter an amount into the calculator above to find out how what kind of.

We would like to show you a description here but the site wont allow us. To calculate the sales tax on your vehicle find the total sales tax fee for the city andor county. The Oklahoma state sales tax rate is 45.

To use our Oklahoma Salary Tax Calculator all you have to do is enter the necessary details and click on the Calculate button. Find your Oklahoma combined. 19 cents per gallon of regular gasoline and.

In Oklahoma this will always be 325. After a few seconds you will be provided with a full breakdown. This marginal tax rate means that.

If you are based in Oklahoma and selling to a buyer with a ship to address in Oklahoma charge sales tax based on the sales tax rate at the ship to. If you make 70000 a year living in the region of Oklahoma USA you will be taxed 11520. To know what the current sales tax rate applies in your state ie.

Other local-level tax rates in the state of Oklahoma are. The statewide sales tax rate in Oklahoma is a minimum of 45. Depending on local municipalities the total tax rate can be as high as 115.

Plus Tax Amount 000. The Oklahoma OK state sales tax rate is currently 45. This takes into account the rates on the state level county level city level and special level.

Consumers can check to see the rate of Oklahoma sales tax charged by county and city. Oklahoma State Tax Quick Facts. 087 average effective rate.

To calculate the sales tax on your vehicle find the total sales tax fee for the city andor county. The base state sales tax rate in Oklahoma is 45. The average cumulative sales tax rate in the state of Oklahoma is 771.

Multiply the cost of an item or service by the sales tax in order to find out the total cost. 325 of ½ the actual purchase pricecurrent value. Minus Tax Amount 000.

Your average tax rate is 1198 and your marginal tax rate is 22. Just enter the five-digit zip. How To Calculate Oklahoma Sales Tax On A New Car.

Local tax rates in Oklahoma range from 0 to 7 making the sales tax range in Oklahoma 45 to 115. Item or service cost x sales tax in decimal form total. However it must be noted that the first 1500 dollars spent on the vehicle would not be taxed in the usual way.

Before Tax Amount 000. 325 of taxable value which decreases by 35 annually. Thats where you need a Sales Tax Calculator like ours which will keep you at ease fully satisfied.

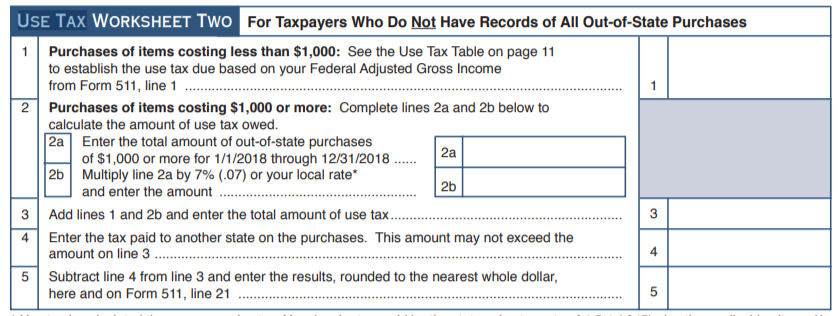

To estimate the amount of use tax you.

Oklahoma Sales Tax Handbook 2022

Oklahoma Tax Commission We Re Going Backtothebasics With Okcars Okcars Is A Convenient Online Resource Used Anywhere Anytime To Quickly Renew Vehicle Registration Order Specialty License Plates And Calculate New Vehicle Sales

How To Pay Sales Tax For Small Business 6 Step Guide Chart

States That Still Impose Sales Taxes On Groceries Should Consider Reducing Or Eliminating Them Center On Budget And Policy Priorities

How To Calculate Sales Tax And Final Price Youtube

Pull Factors A Measure Of Retail Sales Success Estimates For 77 Oklahoma Cities 2018 Oklahoma State University

Consumers Behavioral Response To Sales Taxes On Food In Kansas Document Gale Academic Onefile

Pennsylvania Sales Tax Guide For Businesses

Car Tax By State Usa Manual Car Sales Tax Calculator

4 Ways To Calculate Sales Tax Wikihow

Do I Owe Oklahoma Use Tax Support

What Is Sales Tax A Complete Guide Taxjar

How Do State And Local Property Taxes Work Tax Policy Center

Oklahoma Vehicle Sales Tax Fees Calculator Find The Best Car Price

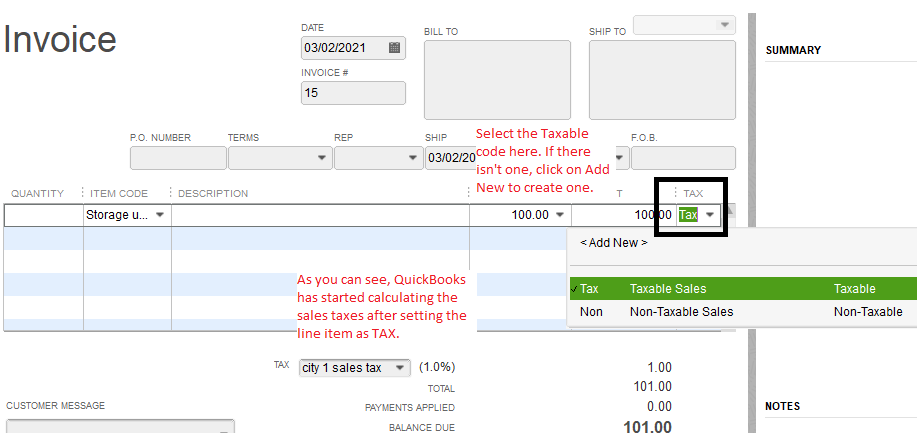

Solved How Do You Add Tax To Estimates And Invoices